TL;DR ⚡

What you’ll learn: How Solana connects fiat, stablecoins, and merchant networks into one fast, low-cost settlement layer.

Why it matters: Institutions now have a clear path from fiat on-ramps to regulated stablecoins and into merchant tools. This enables global payouts, efficient treasury operations, and consumer payments.

Exo Edge: We help teams design and implement these flows. Our experience lies in our connections and our ability to create products suited to our clients ’ needs.

Introduction

Historically, blockchain payments have been held back by slow settlement, high fees, and limited fiat connectivity. Stablecoins changed the economics. Solana changed the experience. Today, the combination of fast finality, low fees, and mature fiat bridges makes Solana a credible global settlement layer.

This report explains how these components fit together and how institutions can use them to build reliable, production-grade payment flows.

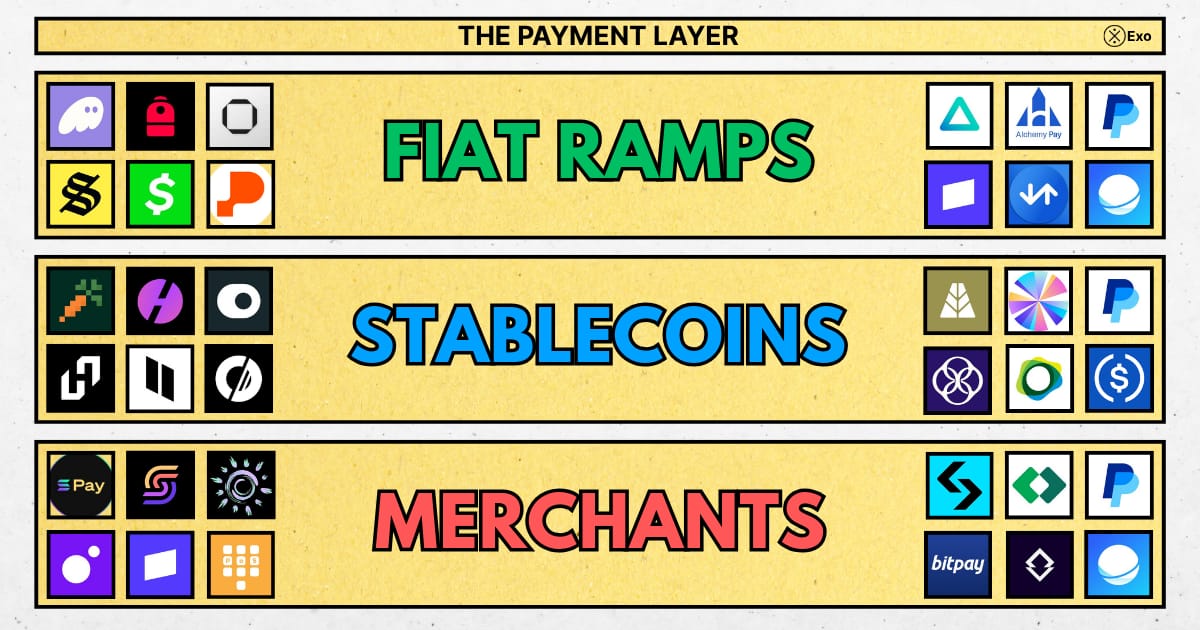

1. The Solana Payments Stack

Solana’s payment stack has essentially three layers:

Moving fiat into stablecoins → Fiat Ramps

Issuing those stablecoins → Stablecoins

Delivering funds to merchants → Merchants

Each layer now has regulated, production-ready providers. The following lists are not exhaustive, but should give a comprehensive overview of the products available. All of which Exo can help you integrate with. If you feel anything is missing, comment where it’s posted!

For an exhaustive list → visit https://solana.com/solanaramp. Also, you can thank Huma Finance for this epic PayFi ecosystem map they put together back in January → https://blog.huma.finance/introducing-the-payfi-ecosystem-map.

1.1 Fiat On & Off Ramps

Users and businesses need a simple, reliable way to move value from bank accounts into stablecoins on Solana. That early step used to be the most painful, but it has dramatically improved thanks to providers who streamline conversion, KYC, settlement, and compliance.

Consider the following examples.

Solflare, a wallet built specifically for Solana. Institutions may operate through custodial systems, but the users they serve will often engage through consumer wallets like this. The experience those wallets provide ultimately defines how people expect payments, transfers, and stablecoin movement to feel.

Cash App is about to expand the consumer funnel in a major way. Once USDC support goes live, tens of millions of users will be able to buy, hold, and send digital dollars in an interface already familiar to them, creating one of the largest organic USDC on-ramps to Solana.

Sphere Labs handles the complex parts of real-world settlement. They abstract away regulatory mismatches, banking complexities, liquidity conversion, and region-specific payout challenges. Instead of teams building fragmented global payment rails, they can simply plug into a unified infrastructure.

Together, these services form a path from fiat entry to on-chain distribution.

As such, the providers below should be categorized essentially in two camps: Consumer Wallets (like Solflare and Cash App) for user experience, and Infrastructure APIs (like Sphere and Transak) for business logic.

Fiat On & Ramp Providers

Project / Type | Target & Reach | Key Features |

|---|---|---|

Solflare / Consumer Wallet | Everyday Users, Global (via partners). | In-wallet purchase aggregator; direct connections to bank/cards. |

Cash App / Mobile App | US Retail Users, US-centric. | Familiar Web2 interface; buy BTC/USDC and send over Solana easily. |

Sphere Labs / Infrastructure / API | Developers & Businesses, Global. | APIs for cross-border settlement; handles FX and liquidity routing. |

Phantom / Consumer Wallet | Everyday Users, Global (via partners). | Aggregates multiple on-ramp providers (MoonPay, Coinbase, etc.) in-app. |

Stripe / Payment Infrastructure | Merchants & Platforms, Major Markets (US/EU/UK). | Native stablecoin payouts; accepts USDC from customers globally. |

Banxa / Gateway Infrastructure | Exchanges & Wallets, Global (130+ countries). | Regulated fiat-to-crypto gateway; widely used by other apps. |

Transak / Gateway Infrastructure | Developers (dApps), Global (160+ countries). | Developer-focused integration for card/bank purchases. |

Alchemy Pay / Hybrid Payment Network | Global Merchants, Global (Strong in Asia/LATAM). | Bridges fiat payment networks (Visa/MC) with crypto settlement. |

Squads / Treasury Management | Institutions / Teams, Global. | Enterprise multi-sig that integrates ramps for safe treasury operations. |

Backpack / Wallet & Exchange | Pro Users / Traders, Global (Regulated markets). | Integrated regulated exchange features directly within the wallet and website. |

Para / Liquidity Infrastructure | Developers, Global. | Routing layer to ensure efficient conversion rates for incoming funds. |

1.2 Regulated Stablecoin Issuance

Stablecoins bridge traditional finance and on-chain settlement. Solana now supports several regulated issuers that institutions can rely on.

USDC from Circle remains the institutional anchor. It is fully reserved, transparent in reporting, and deeply integrated into enterprise payment workflows. On Solana, USDC moves at network speed, making it practical for payroll, B2B transfers, vendor payments, and marketplace settlement where execution time matters.

PYUSD, issued by Paxos and distributed through PayPal, extends stablecoins into everyday user contexts. Functionally, it introduces digital dollars to millions of consumers who are not crypto-native. Its deployment on Solana signals the shift toward stablecoin-powered retail payments and microtransactions that require instant finality and reliability.

AUSD from Agora introduces a stablecoin engineered for institutional settlement and capital flows. Fully backed, operationally transparent, and optimized for predictable performance, AUSD adds redundancy and resilience to the stablecoin layer. This diversification reduces concentration risk and expands the options available to enterprises operating on Solana.

Stablecoin Providers:

Project / Type | Asset Ticker(s) | Primary Use Case |

|---|---|---|

Circle / Fiat-Backed Issuer | Global Settlement. The industry standard for large-scale payments and treasury management. | |

Bridge / Fiat-Backed Issuer / Infrastructure | Custom Issuance & Global Payments. Allows businesses to launch their own branded, rewarded stablecoin and power cross-border payments. | |

Paxos / Fiat-Backed Issuer | Consumer Payments. Deeply integrated into PayPal’s merchant and consumer network. | |

Agora / Fiat-Backed Issuer | Institutional Settlement. Offers enterprise services to launch branded stablecoins. | |

Sky (Maker) / Crypto-Backed Issuer | DeFi Native. The decentralized, crypto-backed alternative for open-source finance. | |

Hylo / Crypto-Backed Issuer | Decentralized Stability. Overcollateralized by Solana Liquid Staking Tokens (LSTs). | |

Solstice / Hybrid / Yield Protocol | Yield & Peg. USX is the dollar peg; eUSX is the liquid staking token earning yield. | |

Huma / PayFi Network | N/A (Credit Lines) | Financing. Powers credit lines for payment processors (e.g., invoice factoring). |

Onre Finance / Reinsurance Token | RWA Yield. A token backed by reinsurance premiums, not a $1 payment peg. | |

Carrot / Yield Aggregator | Optimization. Automated, yield-optimized vaults for managing existing stablecoin holdings. |

1.3 Merchant Acceptance

After issuance, merchants need simple ways to receive funds. Solana now supports both native and mainstream acceptance options.

Solana Pay enables direct on-chain payments through QR codes, links, and API hooks. Settlement finalizes instantly, fees remain negligible, and merchants can wire it in with minimal backend change. For businesses that already operate digitally, it behaves like a faster Stripe with programmable receipts and atomic settlement.

PYUSD acceptance through PayPal allows merchants to receive stablecoins in a familiar interface. This is ideal for businesses that want the benefits of on-chain dollars without having to maintain wallets, private keys, or blockchain logic in their own stack. They get speed and cost-efficiency, while the crypto layer stays invisible.

MoonPay’s strategy for merchant payments evolved significantly with the acquisition of Helio’s technology in early 2025, which now powers the dedicated MoonPay Commerce platform. This unified platform provides merchants, creators, and developers with all the tools needed to accept crypto payments globally and settle instantly in digital assets or automatically convert to fiat.

Together, these rails create a spectrum of acceptance models. From fully on-chain payments to hybrid systems to complete Web2 interfaces settling on Solana, merchants can choose the level of crypto exposure that best fits their operations.

Merchant acceptance providers:

Project / Type | Settlement Method | Integration & Target |

Solana Pay / Open Standard & SDK | Crypto-Only (Direct Merchant-to-Wallet via USDC/SOL) | Developer-Focused. Protocol for developers to build payment/loyalty apps. Target: Tech-savvy e-commerce and POS developers. |

MoonPay / Payment Gateway | Hybrid. Merchants can settle directly in crypto (USDC, SOL, BTC, etc.) or choose auto-conversion to fiat (USD, EUR, etc.) to a bank account. | E-commerce & Platforms. Quick setup via API, paylinks, and plugins. Target: E-commerce stores and digital creators. |

PayPal / Web2 Payment Processor | Hybrid (PYUSD held in PayPal Business Hub, instant conversion to fiat available) | Mainstream Retail. Seamlessly integrated for existing PayPal merchants. Target: Millions of small to large businesses using PayPal today. |

Stripe / Enterprise Payment Infrastructure | Hybrid (Accepts fiat, provides stablecoin payouts; can accept stablecoins for fiat payout) | Enterprise Platforms. Uses stablecoins for efficient B2B payouts to sellers and platforms. Target: Large e-commerce and platform businesses. |

Transak / Global On/Off-Ramp Gateway | Hybrid (Provides fiat-to-crypto checkout for users, and crypto-to-fiat conversion for merchants) | Global dApp Integration. Simple APIs and SDKs to embed crypto payment/off-ramp in minutes. Target: Wallets, dApps, and platforms needing global fiat access. |

Ramp Network / Non-Custodial On/Off-Ramp | Hybrid (Non-custodial by design; enables merchants to receive crypto and manage off-ramp conversion) | Developer & Platform Focus. Embeddable crypto buying and selling for platforms. Target: Applications needing a seamless, regulatory-compliant fiat gateway. |

BitPay / Traditional Crypto Processor | Hybrid (Settles in Fiat (USD/EUR/etc.) or Crypto (BTC/USDC) based on merchant preference) | Enterprise & Compliance. Full-service payment gateway with fiat bank payouts. Target: Global businesses needing fiat settlement and compliance/KYB support. |

Sphere Labs / Stablecoin Payments OS | Hybrid (Automated stablecoin-to-fiat conversion via API) | B2B & Cross-Border. APIs for eliminating prefunding and optimized FX routing. Target: Institutions and businesses with emerging market payouts. |

Visa / Traditional Network Pilot | Hybrid (USDC is used as the high-speed settlement layer behind the scenes) | Bank Partners & Enterprise. Not a direct merchant tool; used by partner banks to reduce backend settlement time/cost. |

Point-of-Solana / Community POS Effort | Crypto / Hybrid (Accepts crypto, often integrates third-party off-ramps for fiat conversion) | POS Hardware & Software. Community-driven efforts to deploy Solana payments on physical terminals. Target: Developers/integrators focusing on hardware POS solutions. |

Got SOL Pay / Point-of-Sale App | Crypto / Hybrid (Accepts crypto, often integrates third-party off-ramps for fiat conversion) | Retail Payments. Direct P2P payment app for in-person transactions using QR/NFC. Target: Small retail businesses and physical locations. |

Pyra / Consumer Credit Protocol | Crypto-Spend (Consumer pays with USDC credit borrowed against SOL collateral) | Consumer Spend Tool. Enables users to spend stablecoins without liquidating collateral. Target: Merchants benefit from increased user spending power. |

Together, these options allow merchants to choose how much of the crypto stack they want to see. Some go fully on-chain. Some stay Web2 but settle on Solana. All benefit from faster, cheaper, and more programmable money movement.

Curious about Pyra? Check out the podcast we filmed with him a few months ago. Want to come on the podcast → Reach out to our host Dirt!

Conclusion

Solana’s payment stack has reached a level of maturity that institutions can finally build on with confidence. Fiat on-ramps are familiar and regulated. Stablecoin issuers operate with transparency and strict oversight. Settlement on Solana is fast, predictable, and inexpensive. And merchants have multiple acceptance paths that fit cleanly into existing workflows.

The result is a complete loop: money enters through providers users already trust, moves as regulated digital dollars, settles instantly on Solana, and reaches merchants or recipients without added friction. This is the first cycle where the full infrastructure exists for global, internet-native payments that feel as seamless as the products built on top of them.

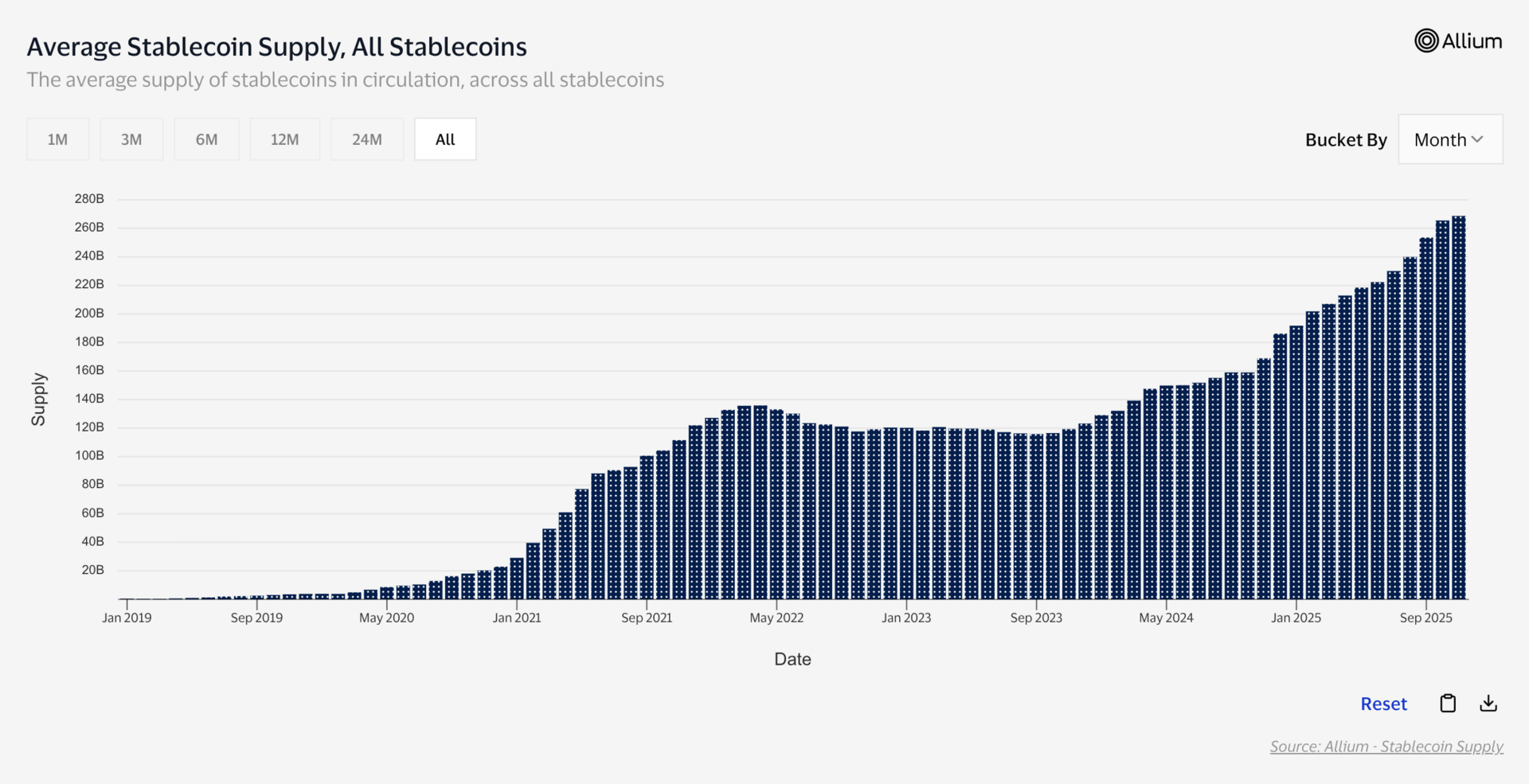

Total stablecoin issuance continues to increase year over year, and Solana is positioning itself not just as a high-performance blockchain but as a settlement layer that connects the traditional financial system to real-time digital money on a global scale.

What’s Next?

In the next part of this series, we’ll explore Market Infrastructure & Execution, eg trading advantages with Jito, Raiku and other high-performance order books.