The Future of Solana Staking Rewards

Pye can change the Solana staking landscape, here's why...

Solana staking rewards have been a hot topic of discussion lately with SIMD123 and SIM228. SIMD228 became a big debate that had a clear divide between large validators vs small and it ultimately failed. SIMD123 passed signaling that the network should be updated to allow validators to distribute block rewards to stakers. A couple big questions now are:

- What is the validator vs. staker allocation function for those rewards?

- How will those rewards be distributed?

For some context, Staking rewards come from 3 places at the moment; staking inflation, MEV, and block rewards. The current allocation of inflation and MEV rewards is based on a fixed % commission rate, where X% of total epoch rewards goes to the validator as commission and the rest gets pro-rated to their stakers.

| Reward Type | Staker allocation function | Distribution method |

|---|---|---|

| Inflation | Fixed % | Stake program |

| MEV | Fixed % | Jito Tip Router |

| Block Rewards | TBD | TBD |

Validators lack tooling to granularly share staking rewards

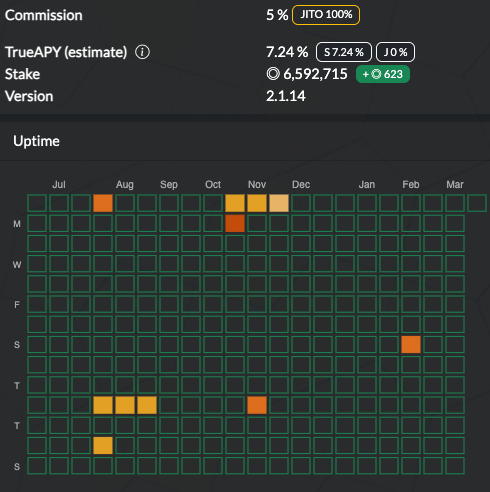

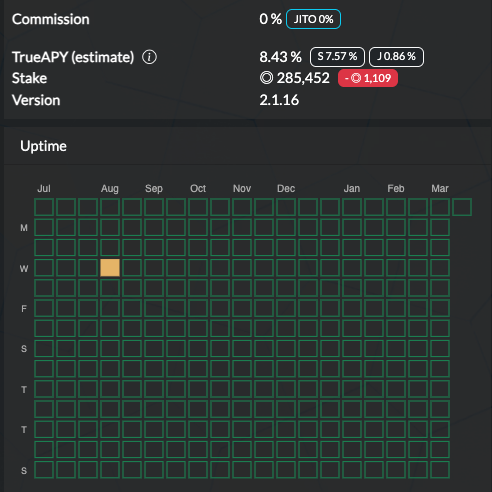

Through Exo Tech’s work with Pye we’ve realized there’s a major missing piece for validators, which is a time lock factor for reward distributions. This is why major validators have high commission on inflation and Jito MEV, but maintain backroom service agreements with whales offering lower commissions for lockups. Often times these validators actually underperform smaller validators, are slower to upgrade their nodes, etc.

High commission and high stake validator with SLAs

Low commission validator with average stake

What is Pye and where does it fit in here? Pye was built on the insight that validators are willing to share more block rewards in exchange for longer term deposits. To solve this issue, Pye is building a platform for issuing fixed duration bonds on top of StakePool LSTs (jitoSOL, bSOL, and sanctum launched LST), mSOL, and native staking to a single validator. It solves this duration problem in a more flexible and extensible manner than the Stake programs lockup and custodian mechanism.

Pye provides validators with a smart contract layer where they can configure block reward sharing and customize it according to the length of a delegators deposit. Allowing relationships that were previously off-chain SLAs to come on-chain. This has the potential to even the playing field for small validators vs large validators. Whales no longer have to be locked into long term contracts with a single vendor and are free to spread their stake out while maintaining their target rewards allocations for the long term time commitment. This should further decentralize the Solana network and make it more accessible for other validators to maintain profitability.

Pye also provides a marketplace for principle and yield tokens to be traded. This is a critical piece that allows stakers to change their validator allocations, for whatever reason, without having to wait for epoch boundaries and without harming a validator’s long term stake. Pye's marketplace allows stakers to opt-in and opt-out of their lockups. More details can be found on their blog.

Now lets talk about our view on distribution.

Jito's TipRouter solves the distribution problem

Jito’s TipRouter is the most flexible and decentralized distribution layer. It leverages Jito’s node consensus network to create robust decentralized and transparent distribution of rewards. Many nodes, 16 at present, run a deterministic process for creating a merkle distribution of rewards based on the previous epochs rewards, its stake delegations, and submitting the root hash. They must then come to consensus on the merkle root before rewards can be distributed through the Tip Distribution program. (read more about TipRouter NCN)

The flexibility of TipRouter leaves a lot of room for quick iterations and improvement as the Solana ecosystem develops or changes. We don’t see the same flexibility with the native Stake program, which is why we think TipRouter is the best stack for reward distribution. In this case, Jito’s TipRouter could be updated to understand Pye’s reward distribution parameters, allowing validators to have more granular levers, while maintaining decentralized reward distributions.

While Jito’s TipRouter is the ideal reward distribution method for validators issuing Pye Liquid Staking Bonds (LSBs), the platform can be proven out with a more centralized distribution mechanism while maintaining the transparency of distributions on-chain. Validators can run a simple CLI that manages the epoch distributions.

Exo Tech is doubling down on its investment in Pye and working with their core team to build out the programs in this system. We see a bright future that will evolve to solving many problems for both validators and stakers that no one is tackling today.

Disclaimer: Exo Tech holds positions in JTO and Pye.